There’s a lot of honestly pretty dumb stuff going on in the world of NFTs lately,

and @jack selling an NFT of his first tweet

is probably not the dumbest thing we’re going to see before this is all over. That

said, there are lots of blog posts on either side of the NFT “debate” (TL;DR: they’re

either a huge new revenue stream for creatives, or they’re a pointless waste of energy),

and I felt compelled to write something on NFTs.

This is not that post.

This post is about art.

Let me start by saying, I am not a connoisseur of fine art. I have an engine block sitting in my living room which aspires to one day be a watch winder, and for most of the last few years, the only framed thing I owned was a pixelated, isometric, and potentially explicit, depiction of LA. I’ve recently added to the collection, but it’s hard to call prints where the frames are more expensive than the print “fine art”.

But there’s one piece of art that I absolutely crave.

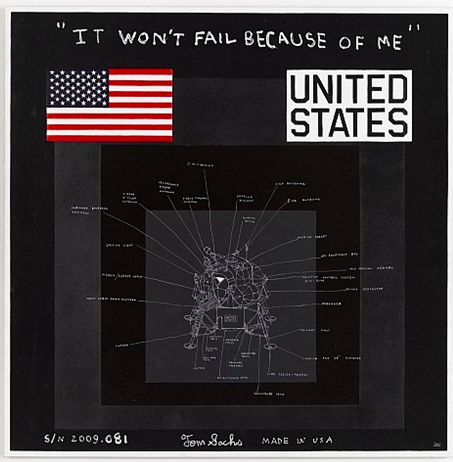

Since about 2010, I’ve had a Chrome theme from artist Tom Sachs that’s a scale model of the lunar lander, with the motto “IT WON’T FAIL BECAUSE OF ME”. I love this motto. As an engineer (by training and by heart, if not by profession), it speaks to something deep inside me: without me, we would not be able to accomplish greatness.

Since I don’t have a place to put a scale model of the Apollo lander (though definitely do have the Lego version), I settled for trying to get one of his paintings with the lander as well as that motto.

After years of procrastinating, I finally tracked down the gallery and sent them an email. They sent back a few snobby responses before finally sending over a price sheet for the pieces of art they had, including this one.

140.000 was listed under that particular piece.

“Woah, $140? That’s super reasonable!” I thought. “But what an odd way to represent the cents…”

“Oh wait, this gallery is in Europe. Shit. They’re asking $140,000 for a piece of canvas?!”

I quickly went from “totally reasonable” to “I’d much rather buy a Porsche Cayman GT4” (and have enough left over for a few years of time trials).

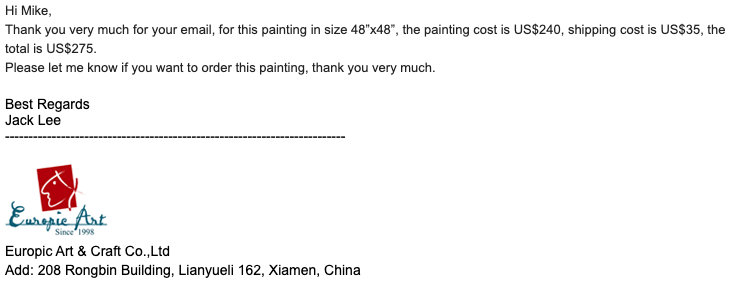

But I also really liked that piece of art, so I reached out to several “fine art replicators” (you’re welcome to interpret that phrase however you’d like), and Jack, in Xiamen, got back to me in under six hours:

Much closer to my original, albeit mistaken, price.

I can get more or less the same painting for three orders of magnitude less. What’s the catch?

Clearly, I’d be buying a forgery (ahem fine art replica), but who cares? I’m not trying to pass it off as the real thing (I was even thinking that we should sign it “Made in China”), I just like the piece. The difference in price is clearly the provenance of the painting: one is an original, meticulously painted by Tom in his studio in NYC, and one, well, that one is produced in what is probably a sweatshop in southern China by someone who churns out a Picasso a week.

This led me to a realization about the price of art: “traditional” art prices consist of both tangible and intangible costs.

The tangible costs:

- the physical materials cost (let’s just say a this is a few hundred dollars)

- the labor associated (similarly, likely a few hundred dollars)

The intangible costs:

- the “idea”, e.g. “IT WON’T FAIL BECAUSE OF ME” (depends on the idea, but hundreds to thousands?)

- the signaling value of owning an original piece of the art in question (depends on the art, but potentially infinite?)

This is the part of the post where we get back to NFTs.

Initially, my thought was, “Wow, NFTs are dumb, there’s nothing tangible associated with the

thing you’re buying, because anyone can view @jack’s tweets on www dot twitter dot com.”

Then I realized, “Holy shit, NFTs are brilliant, they recognized that the tangible value of digital art is $0, yet have created a way to monetize the intangible ‘value’ of said art.” It’s brilliant. Also extremely stupid, but welcome to the economy in 2021.

NFTs have captured the intangibles of art (the provenance, which translates to signaling value), while recognizing that the tangible aspect (you know, the part where anyone can view or download the art) is worthless. It’s honestly a brilliant maneuver by whoever is selling them.

So where do we go from here? Since the entire point of NFTs is signaling (that’s where the value is) how is this communicated? You can’t wear an NFT like a Rolex or carry one like a Birkin.

NFT platforms presumably let you verify ownership, but the MoMA doesn’t currently display a tweet on loan from the M. McDonald charitible trust, and until that happens, I don’t think NFTs have staying power. Owning a tweet doesn’t impress your social circle (and if it does, you live in the SF bubble and should really consider moving somewhere else). Unfortunately, many institutions won’t recognize NFTs, because doing so would relegate the art they have as intrinsicly worthless, and only worth some made up value that a greater fool will pay (would love to see someone track down transfers and see if they’re between related entities–would bet that a large % are between the same person to drive the price up and try to get some unrelated entity to buy it, who then finds out that no “real” person is willing to buy it [or maybe some other “greater fool” really is, in which case… what am I doing in software???]).

So where does this leave us with respect to NFTs? In my opinion, they’re hype and/or money laundering by people who are exploiting the fact that they’re a purely intangible asset. If I were you, I would just download the artwork, or view the tweet–but if you want to play a game of imaginary values for intangible assets, go for it.

I wish you the best of luck, as I’ll be drinking more Hakushu 12 highballs while checking out the best pixelated view of LA.

As always, if you have thoughts, I’d love to hear from you on Twitter or via email.